Federal withholding calculator paycheck

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Take these steps to fill out your new W-4.

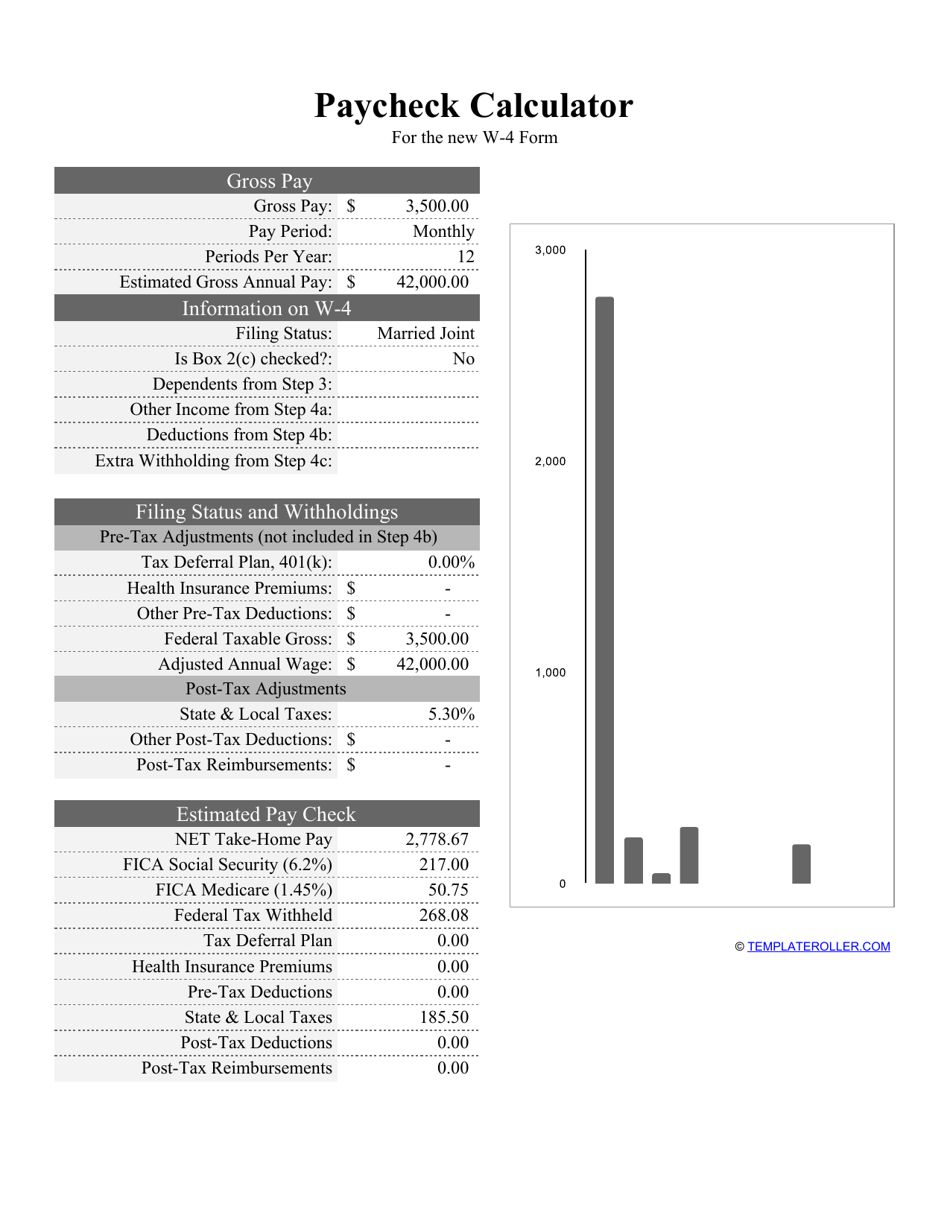

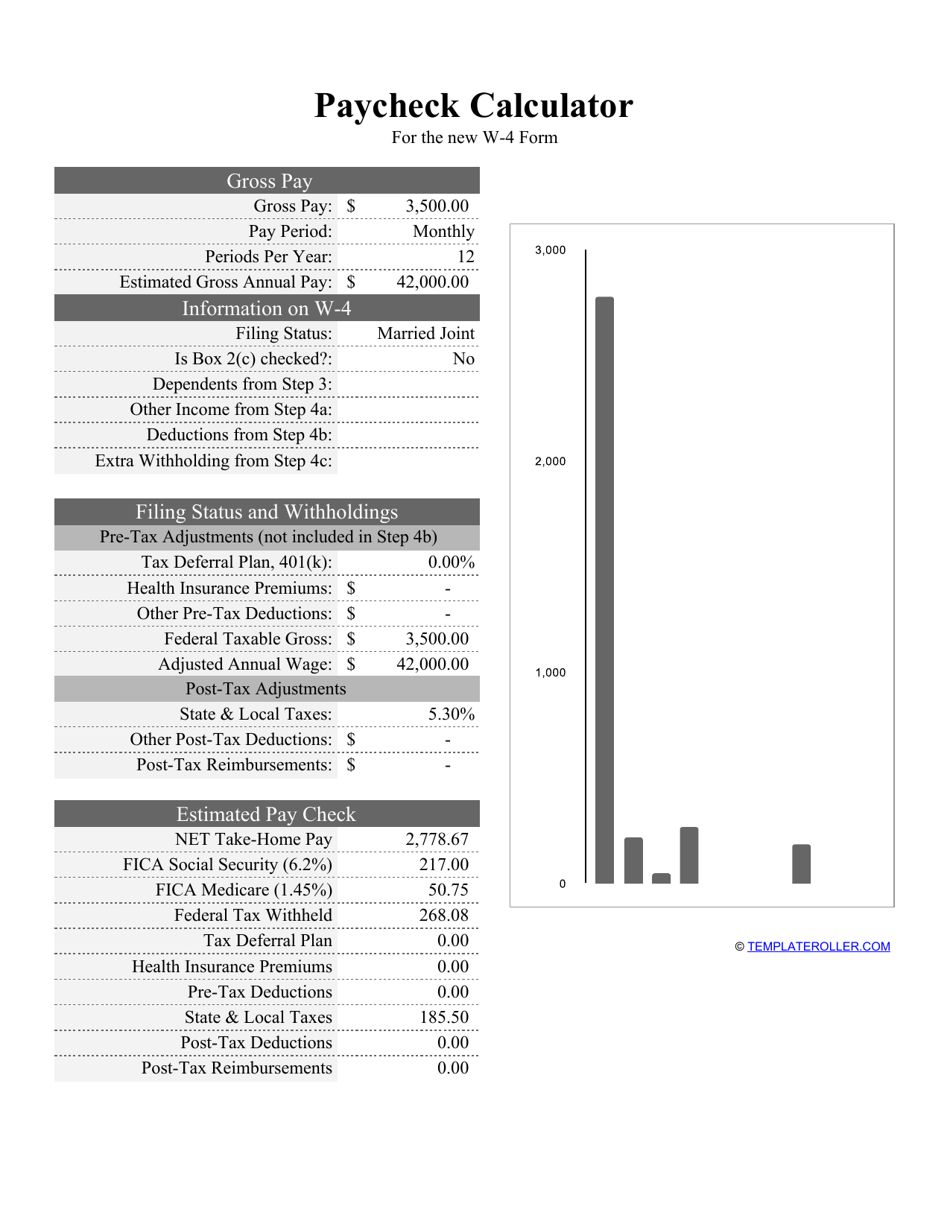

Paycheck Calculator Template Download Printable Pdf Templateroller

For employees withholding is the amount of federal income tax withheld from your paycheck.

. 250 and subtract the refund adjust amount from that. Instead you fill out Steps 2 3 and 4. Make Your Payroll Effortless and Focus on What really Matters.

For example in your 2018 tax return you paid only 10 percent on the first. 250 minus 200 50. Tips for Using the Federal Withholding Calculator The Federal Withholding Calculator can.

To calculate withholding tax the employer first needs to gather relevant information from the W-4 form review any withholding allowances and then use the IRS. Total annual income Tax liability. Subtract any deductions and.

That result is the tax withholding amount. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. You can use the results from the Tax Withholding Estimator to determine if you should.

Learn About Payroll Tax Systems. Free Federal and State Paycheck Withholding Calculator. Feeling good about your numbers.

Thats where our paycheck calculator comes in. For a hypothetical employee with 1500 in weekly. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any.

Learn About Payroll Tax Systems. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. This number is the gross pay per pay period.

Collect required documents Gathering all relevant documents from your employees is the first step in correctly. Sign Up Today And Join The Team. Due to payroll processing time frames it can take up to 8 weeks for the change to go into effect.

All Services Backed by Tax Guarantee. Before starting take a moment to print a copy of your latest Earnings Statement or Paycheck stub so you can easily enter the most accurate values into the calculator. Withhold all applicable taxes federal state and local Deduct any post-tax contributions to benefits Garnish wages if necessary The result is net income How to calculate annual income.

Ad Compare Prices Find the Best Rates for Payroll Services. Be sure that your employee has given you a completed. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

To change your tax withholding use the results from the Withholding Estimator to determine if you should. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Total Gross Earnings per.

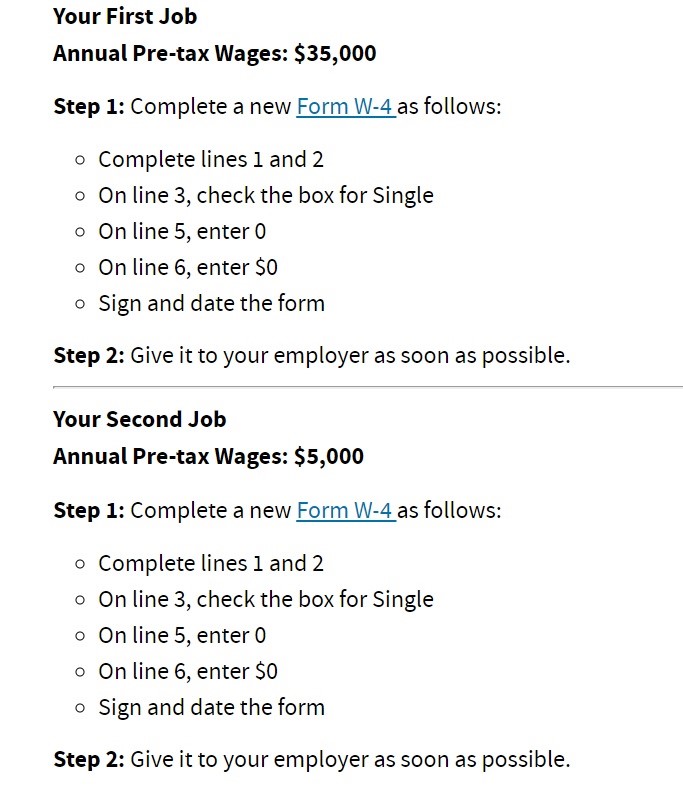

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it. The amount of income tax your employer withholds from your regular pay. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

Sign Up Today And Join The Team. The federal income tax is a progressive tax which means that as you earn more you pay a higher rate. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022.

Complete a new Form W-4 Employees Withholding Allowance. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Follow the steps below to calculate federal withholding tax rate. Over 900000 Businesses Utilize Our Fast Easy Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself.

All Services Backed by Tax Guarantee. Then look at your last paychecks tax withholding amount eg.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

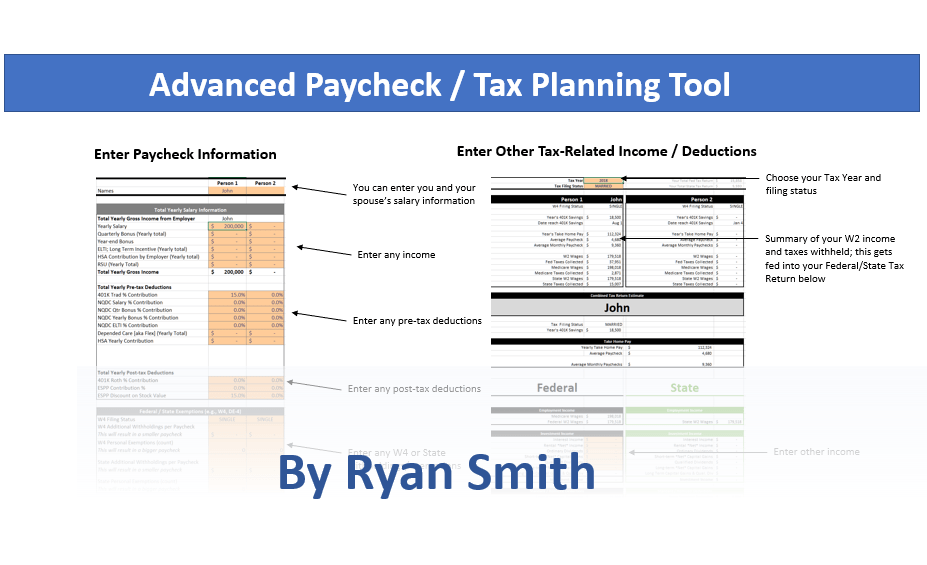

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

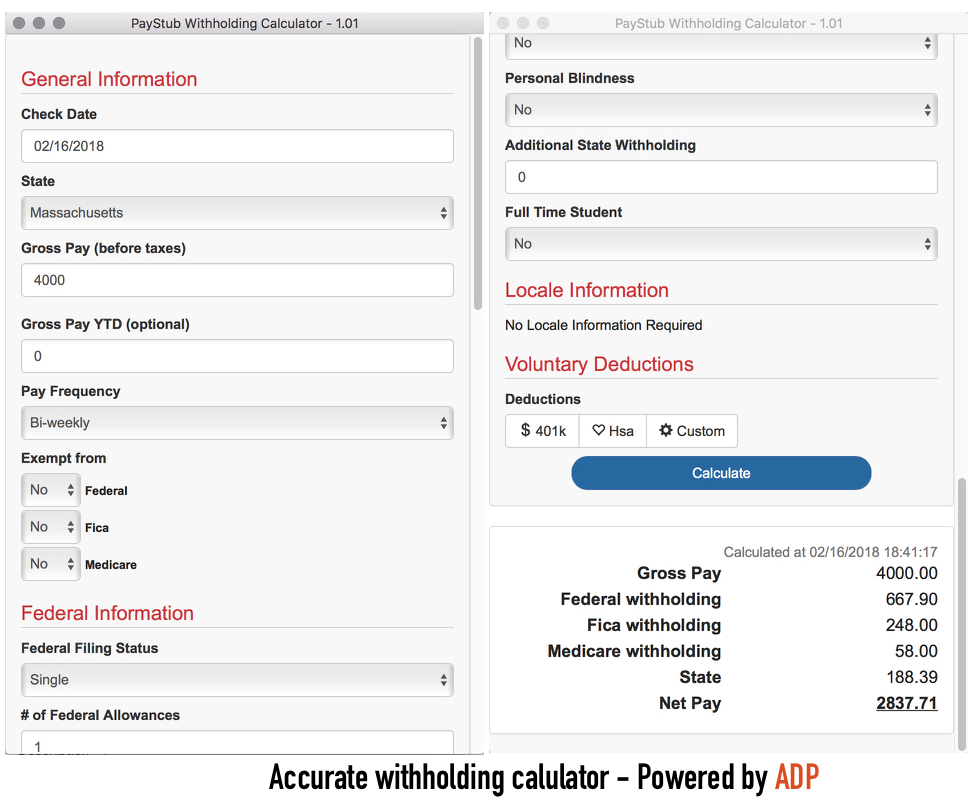

Withholding Calculator Paycheck Salary Self Employed Inchwest

Tax Withheld Calculator Hot Sale 53 Off Ilikepinga Com

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Check Your Paycheck News Congressman Daniel Webster

Free Payroll Tax Paycheck Calculator Youtube

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Take Home Pay Calculator

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll